How to Verify a Deriv Account in 2026: Step-by-Step KYC Guide, Documents & Approval Time

Verifying your Deriv account in 2026 is an essential step to unlock full trading features, ensure account security, and comply with KYC requirements. The verification process is straightforward and helps protect both your funds and personal information.

In this step-by-step guide, you’ll learn how to verify a Deriv account, what documents are required, how long approval typically takes, and how to complete the process smoothly so you can trade with confidence and uninterrupted access to all Deriv services.

Deriv Verification Process Overview

Deriv is a well-established online trading platform that provides access to a wide range of global financial markets through flexible and innovative trading solutions. Evolving from the Binary.com brand, Deriv serves traders worldwide with a strong emphasis on advanced technology, transparency, and a seamless user experience.

The platform allows traders to participate in markets such as forex, commodities, indices, cryptocurrencies, and synthetic indices, making it suitable for both beginners and experienced traders.

Below is a brief overview of the Deriv verification process, designed to help you confirm your identity, secure your account, and unlock full access to Deriv’s trading features safely and efficiently.

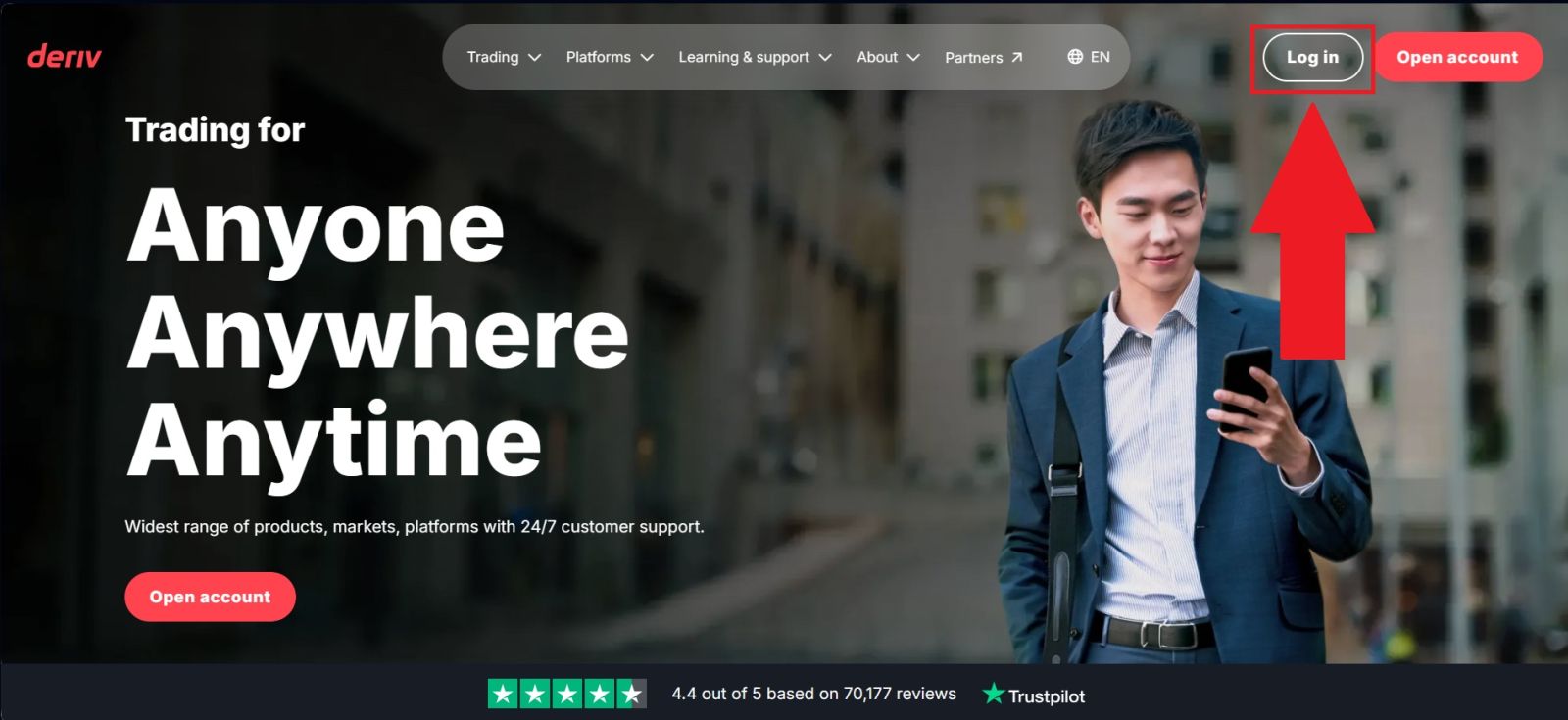

#1 Access the Official Deriv Forex Website

Start by visiting the official Deriv website and carefully confirm that you are on the legitimate platform to protect your account from phishing attempts. The website’s user-friendly layout makes it easy to find essential options.

From the homepage, select [Log in] to be taken to the login page, where you can securely sign in to your account.

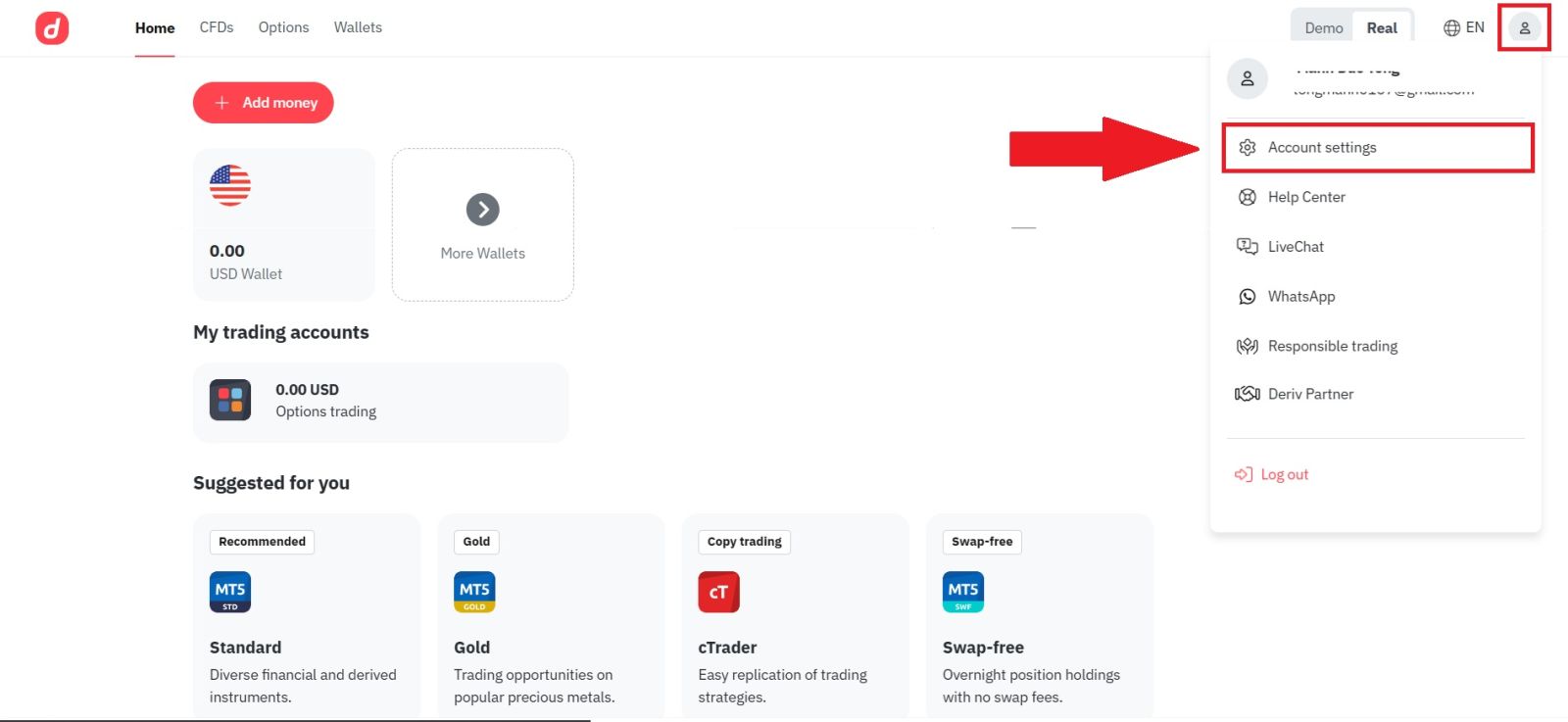

#2 Access the Verification Section

After successfully logging in to your Deriv account, click on the Profile icon and navigate to Account Settings. From there, select Verification to access the account verification section, where you can begin the process of confirming your personal and identity details.

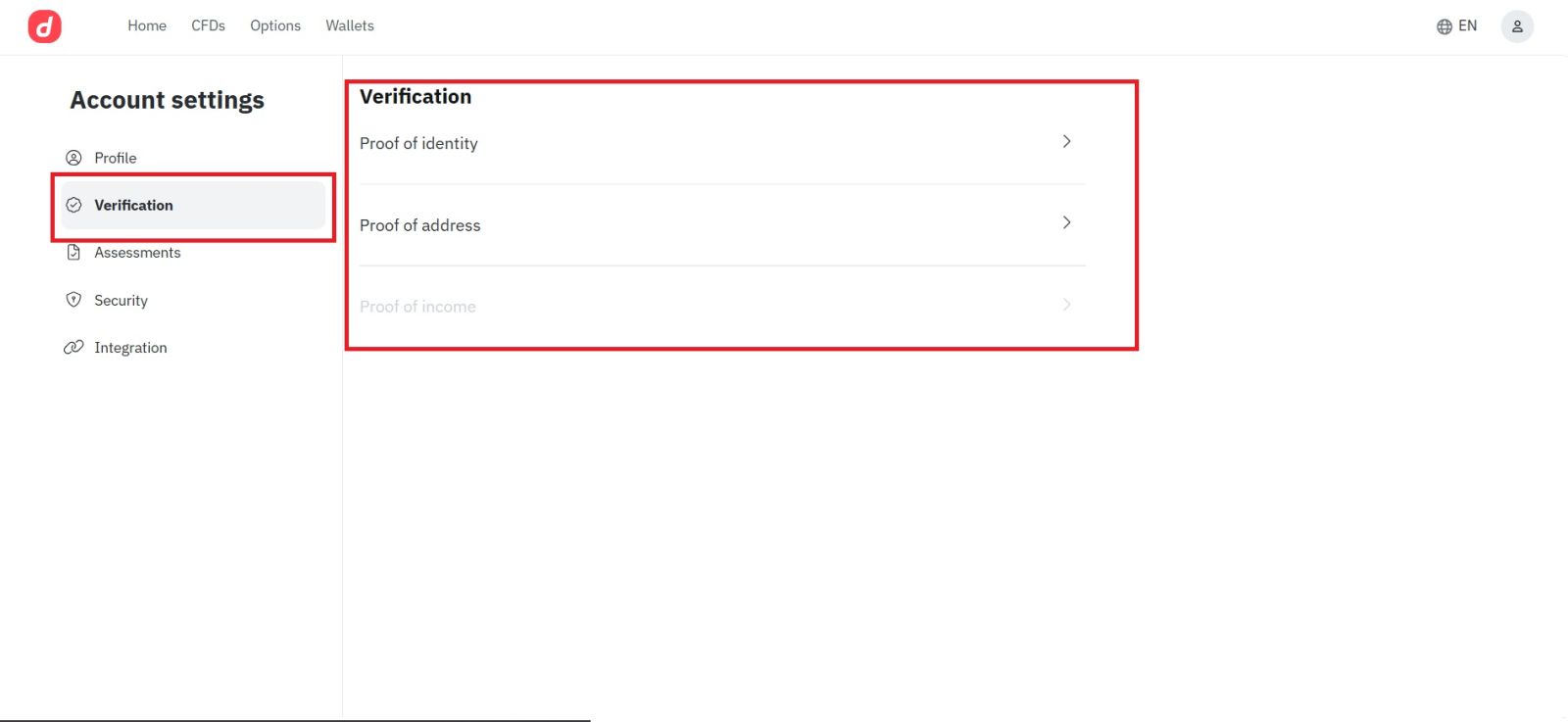

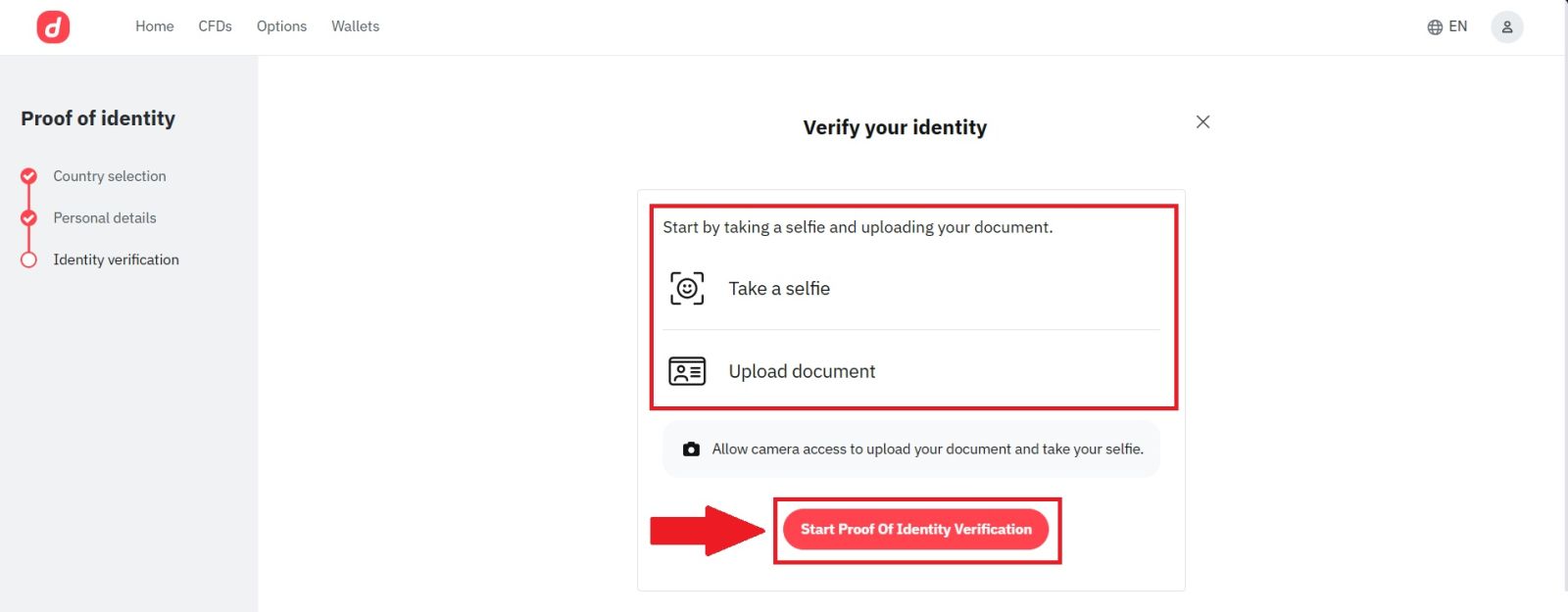

#3 Proof of Identity Verification

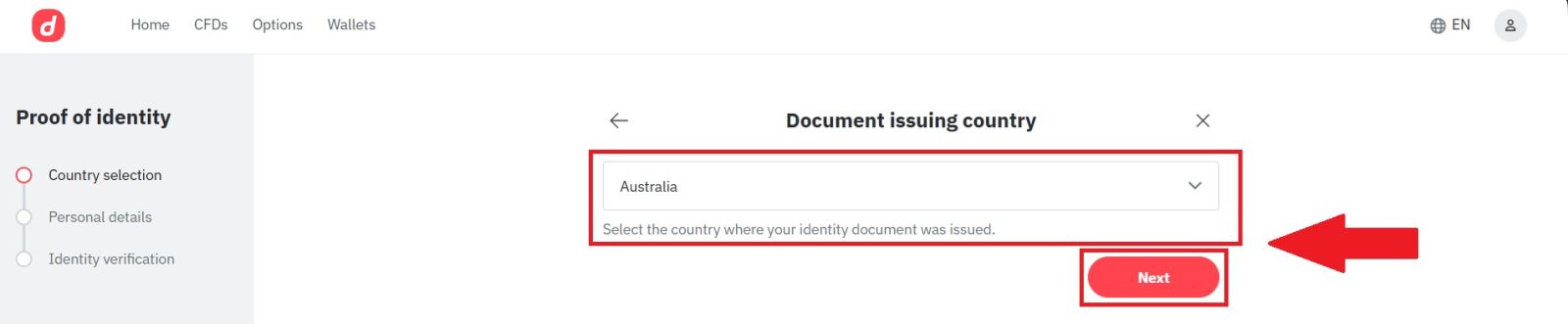

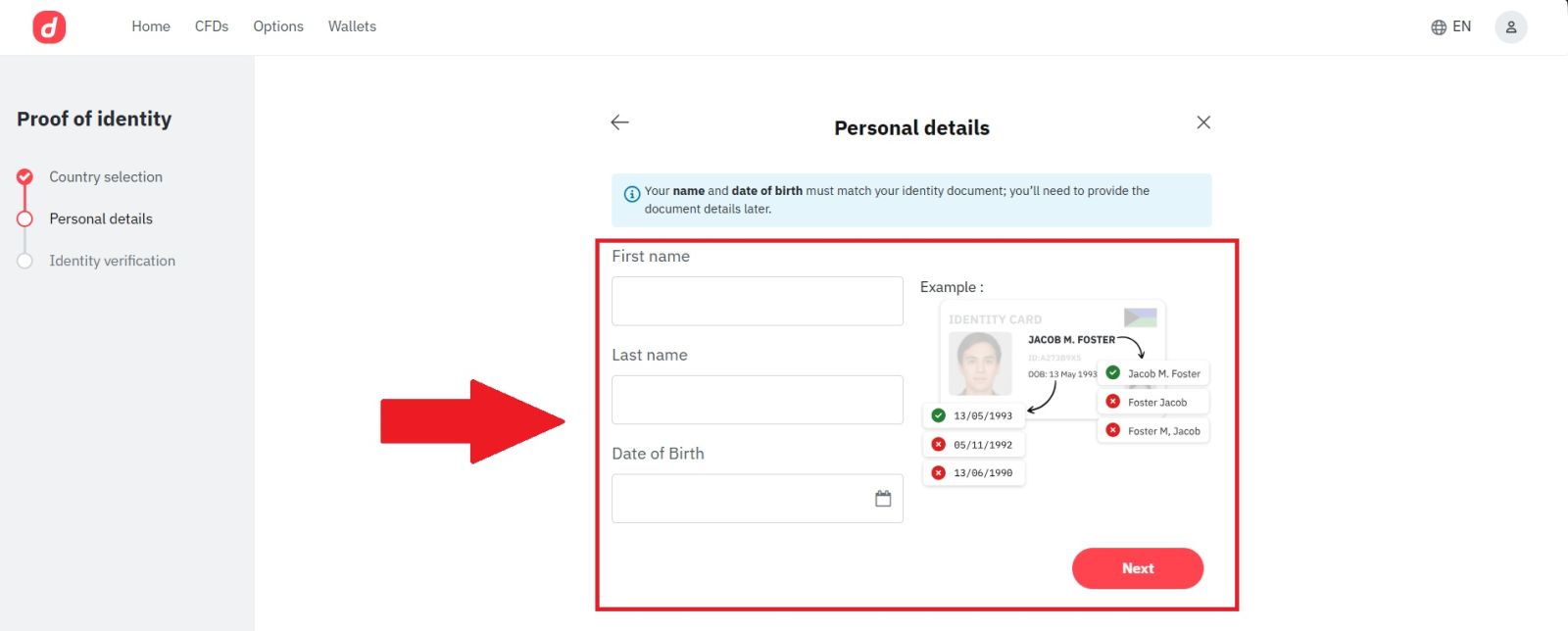

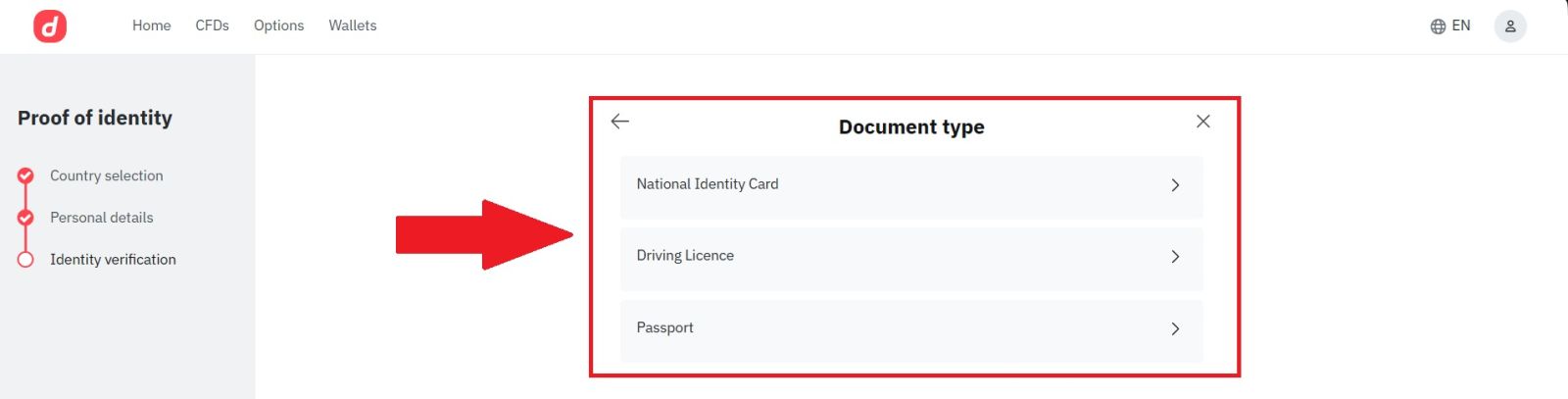

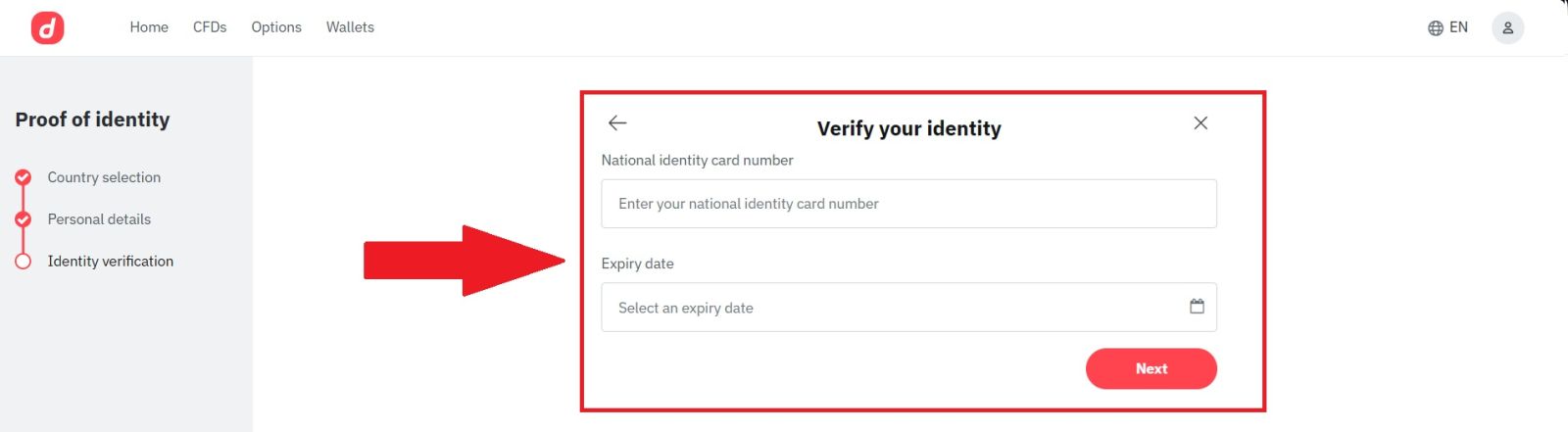

Select the country that issued your identification document and carefully enter your personal details as requested. Next, choose the appropriate document type and provide the required document information.

Once completed, click [Start Proof of Identity Verification] to proceed with the identity check, where you will be asked to take a selfie and upload clear images of your identification document.

After submitting these materials, the verification process will be complete, and your information will be reviewed accordingly.

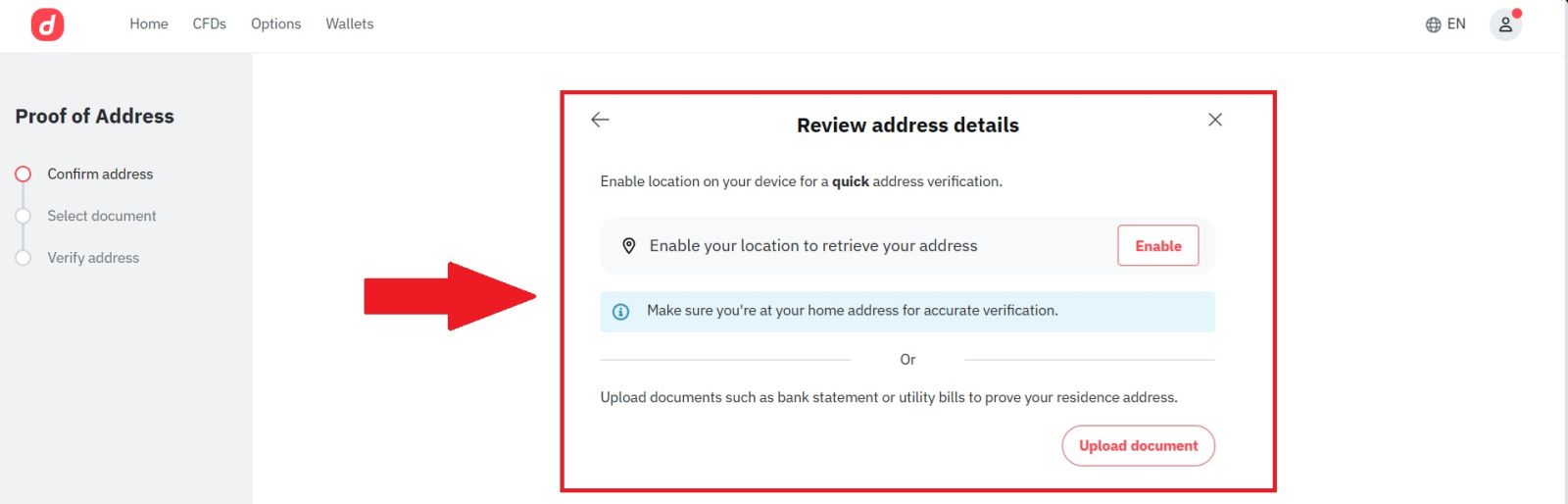

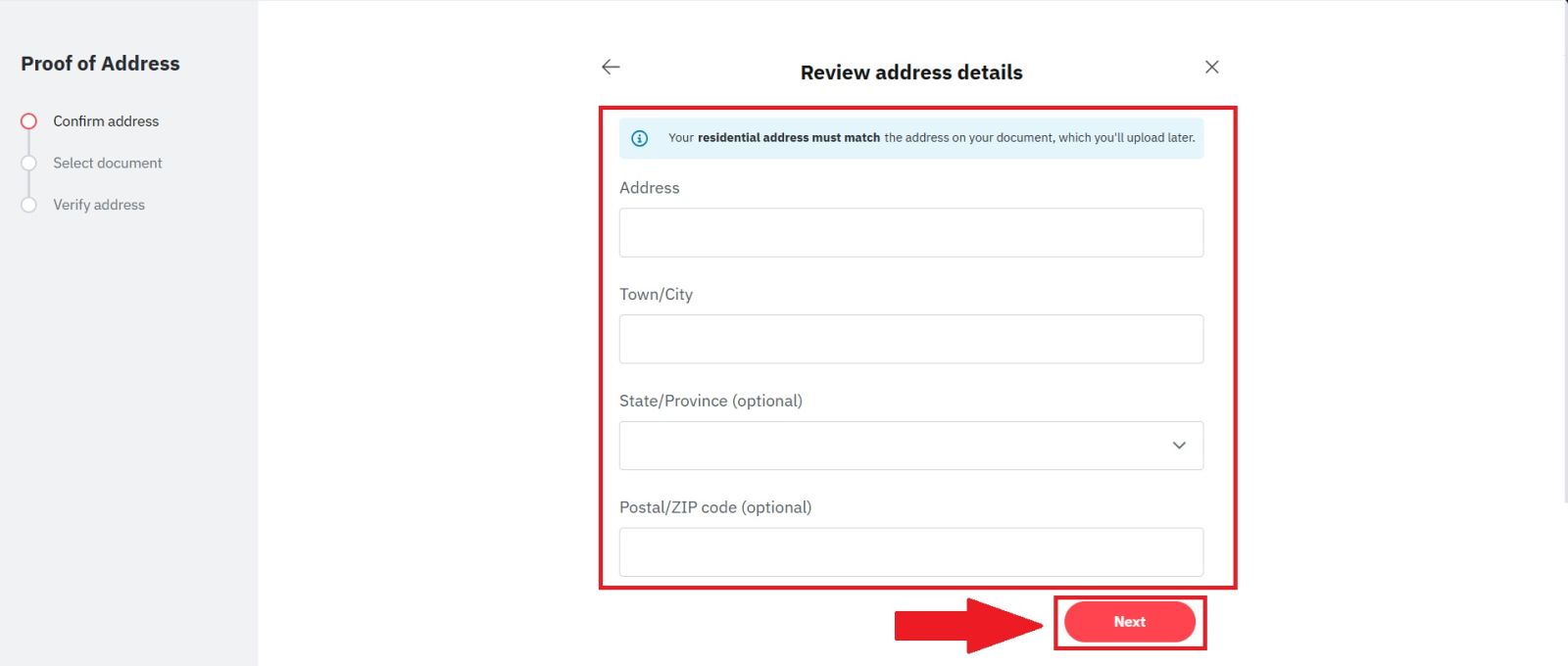

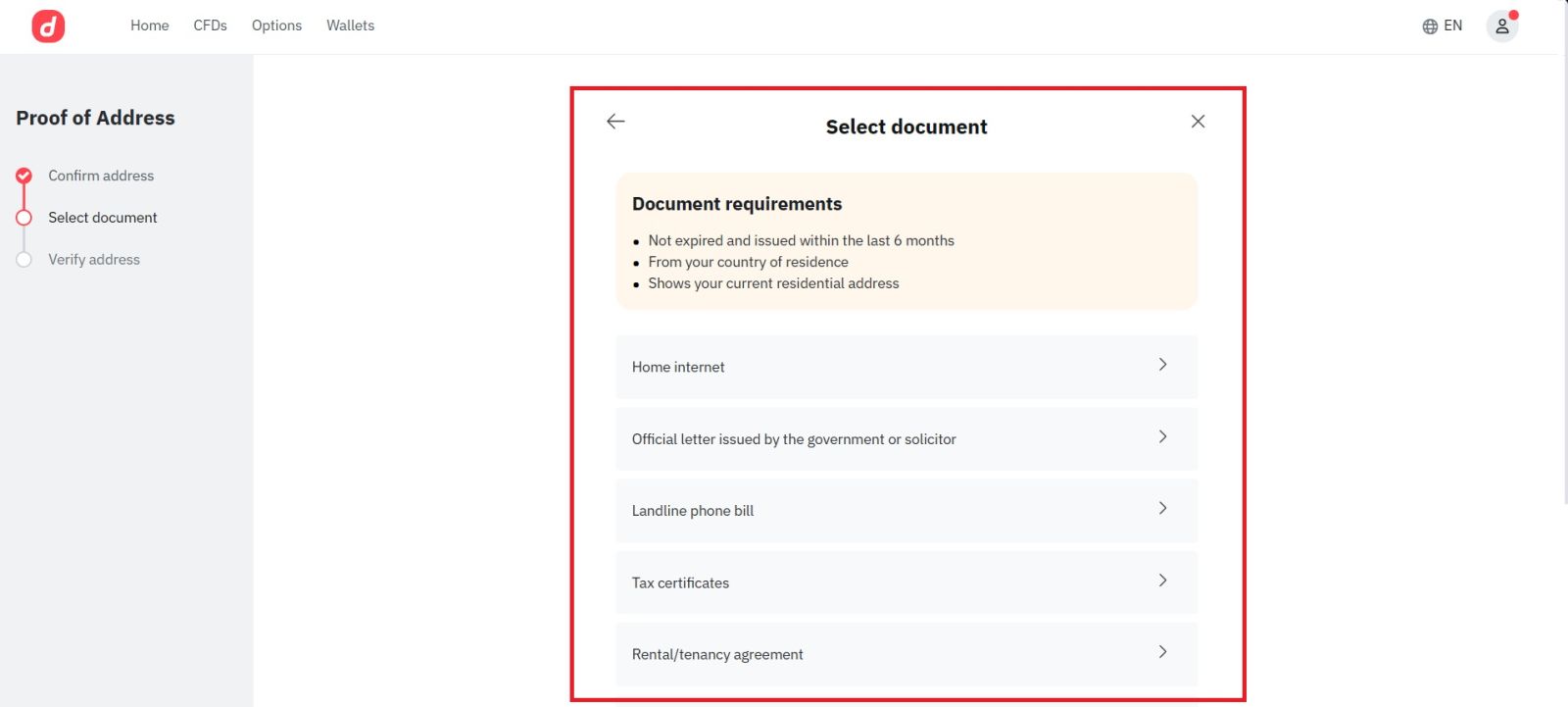

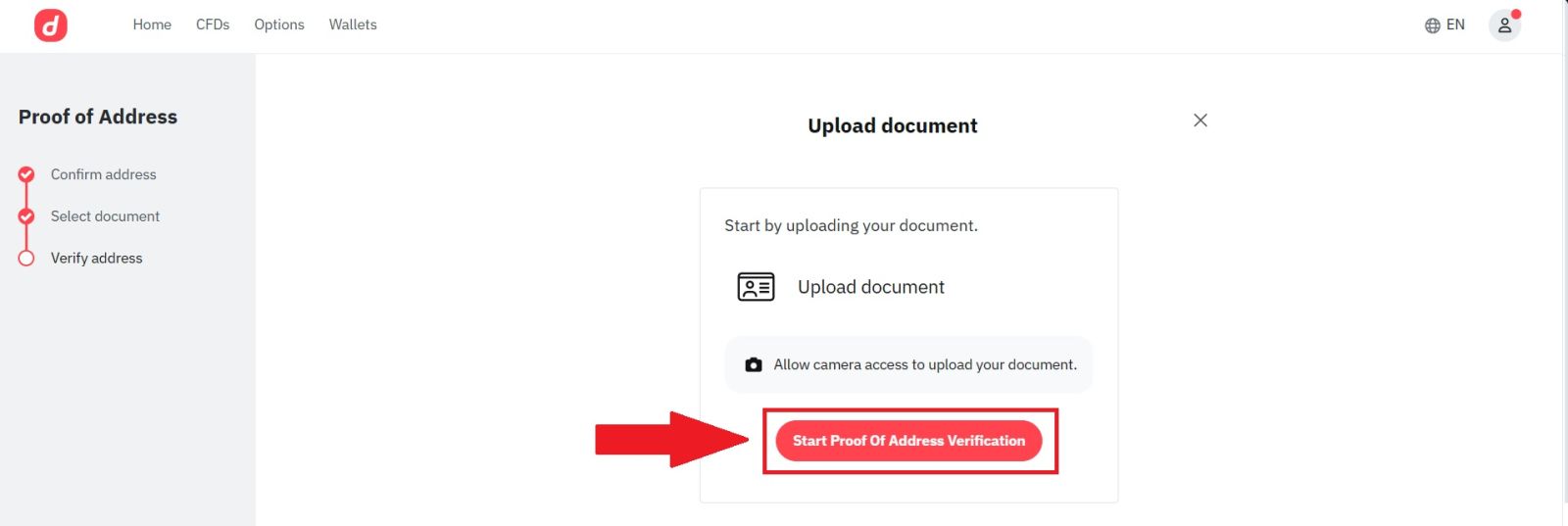

#4 Proof of Address Verification

To complete the address verification, you can enable location services on your device for a faster verification process, or alternatively upload supporting documents such as a bank statement or a recent utility bill to confirm your residential address. Carefully review the address details displayed on the screen and click [Next] to continue.Then, select the required documents and click [Start Proof of Identity Verification] to proceed with the verification process.

After submitting these materials, the verification process will be complete, and your information will be reviewed accordingly.

#5 Deriv Verification Completed

After submitting all the required information and documents, your Deriv account verification will be successfully completed once it is reviewed and approved.You will receive a confirmation notification, and your account will gain full access to all Deriv features, including deposits, withdrawals, and live trading.

Conclusion: Complete Your Deriv Account Verification with Confidence

Verifying your Deriv account is a key step to unlock full access to trading features, secure transactions, and higher limits. By following the KYC process, submitting the correct documents, and understanding approval timelines, you ensure a smooth and efficient verification experience.A fully verified account enhances security, supports deposit and withdrawal flexibility, and helps you trade with peace of mind. With the verification complete, you can enjoy greater confidence and full platform access on Deriv.